Investing powered by

data science, AI, and systematic analysis

rather than human intuition.

ABillion relies primarily on analyzing data

rather than gut instinct, speculation, or subjective judgment

to make financial decisions.

The goal is to uncover patterns, signals, and opportunities from large sets of structured and unstructured data to improve returns and manage risk.

Uses statistical models, algorithms, and historical financial data (prices, volumes, fundamentals) to generate signals.

Goes beyond traditional financial statements

Uses statistical models, algorithms, and historical financial data (prices, volumes, fundamentals) to generate signals.

Strategies are tested against historical data to check performance before deploying real capital.

Human + Machine

Successful investing isn’t about choosing between tech

It’s about combining strengths.

ABillion amplifies your investing expertise using

advanced analytics + your experience.

Abillion’s features & functionalities

In a crowded market of stock analytics platforms, Abillion stands apart by:

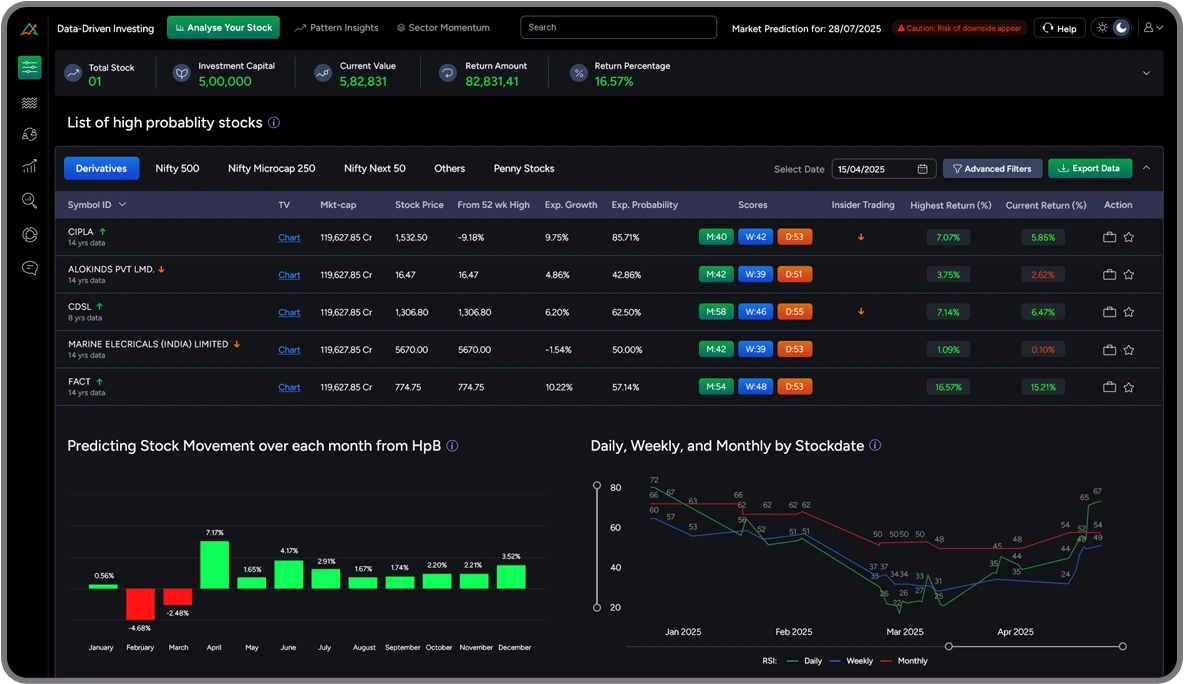

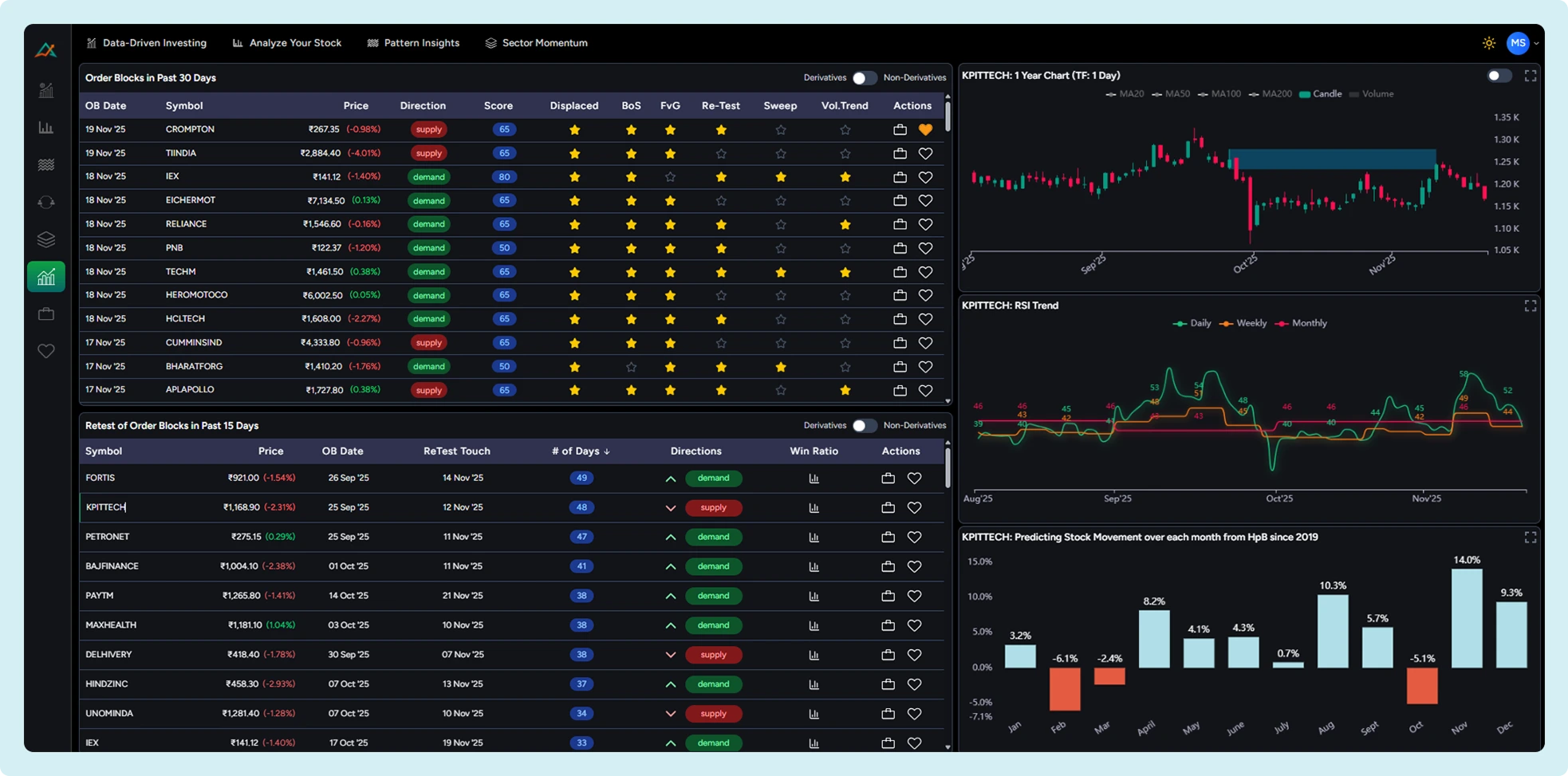

Data-Driven Investing

Make objective, high-confidence investment and decisions using real-time market analytics, probability models, and smart scoring systems. Abillion stock analytics engine filters noise and highlights stocks worth your attention backed by data, not hype.

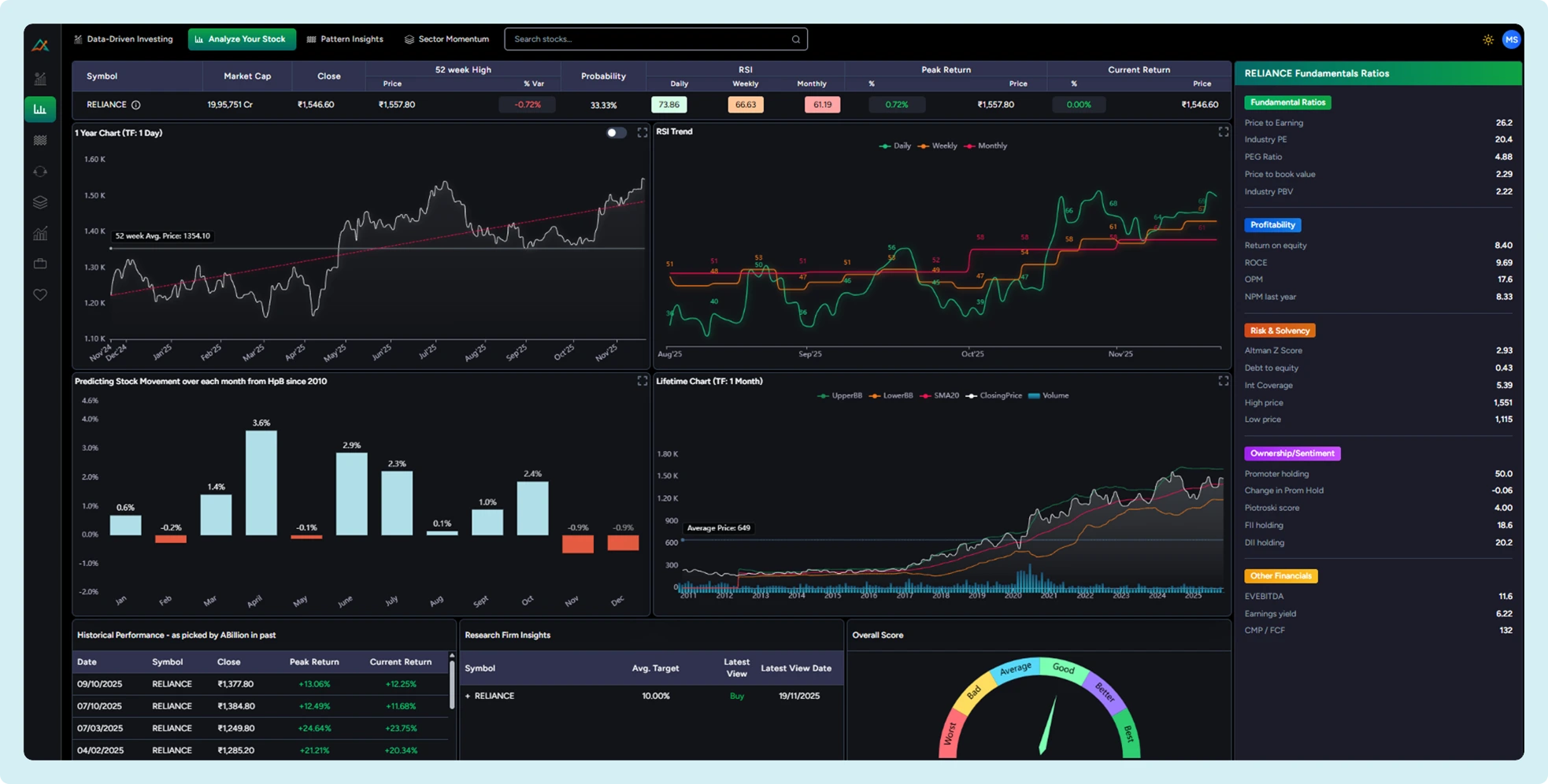

Analyze Your Stock

Get a complete 360° view of any stock technical, fundamentals, insider activity, sentiment, risk score, and long/short signals-all in one screen. Perfect for both quick checks and deep research before you buy or exit.

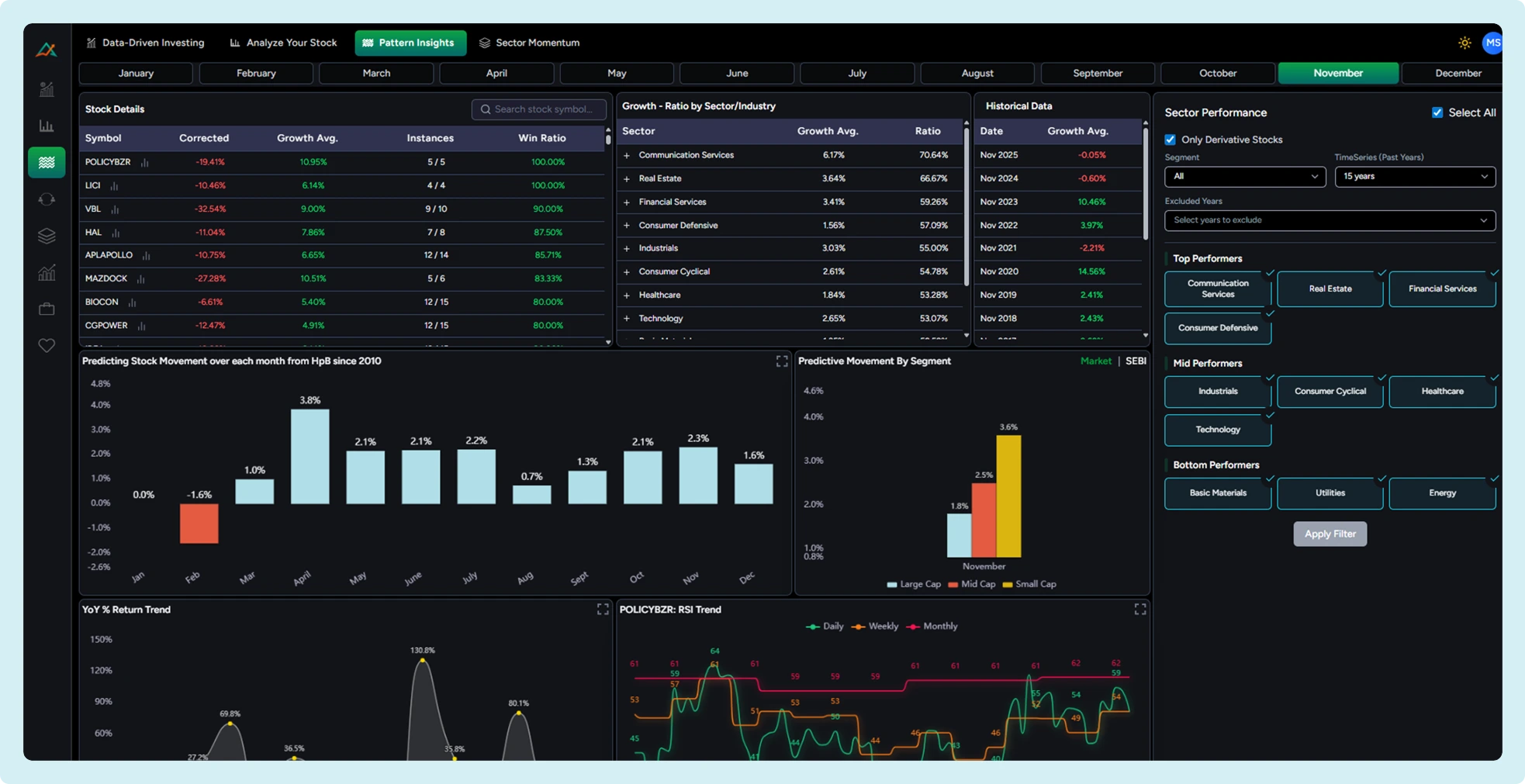

Pattern Insights

Identify powerful chart patterns like breakouts, reversals, consolidations, and momentum shifts detected automatically by AI. No need for manual chart reading; get clear entry, peak and low readings and probability insights instantly.

Fundamental Insights

Understand a company’s true strength with easy-to-read financial summaries: revenue trends, profitability, growth indicators, balance sheet health, and valuation signals.

Designed to simplify institutional-level fundamentals for everyday investors.

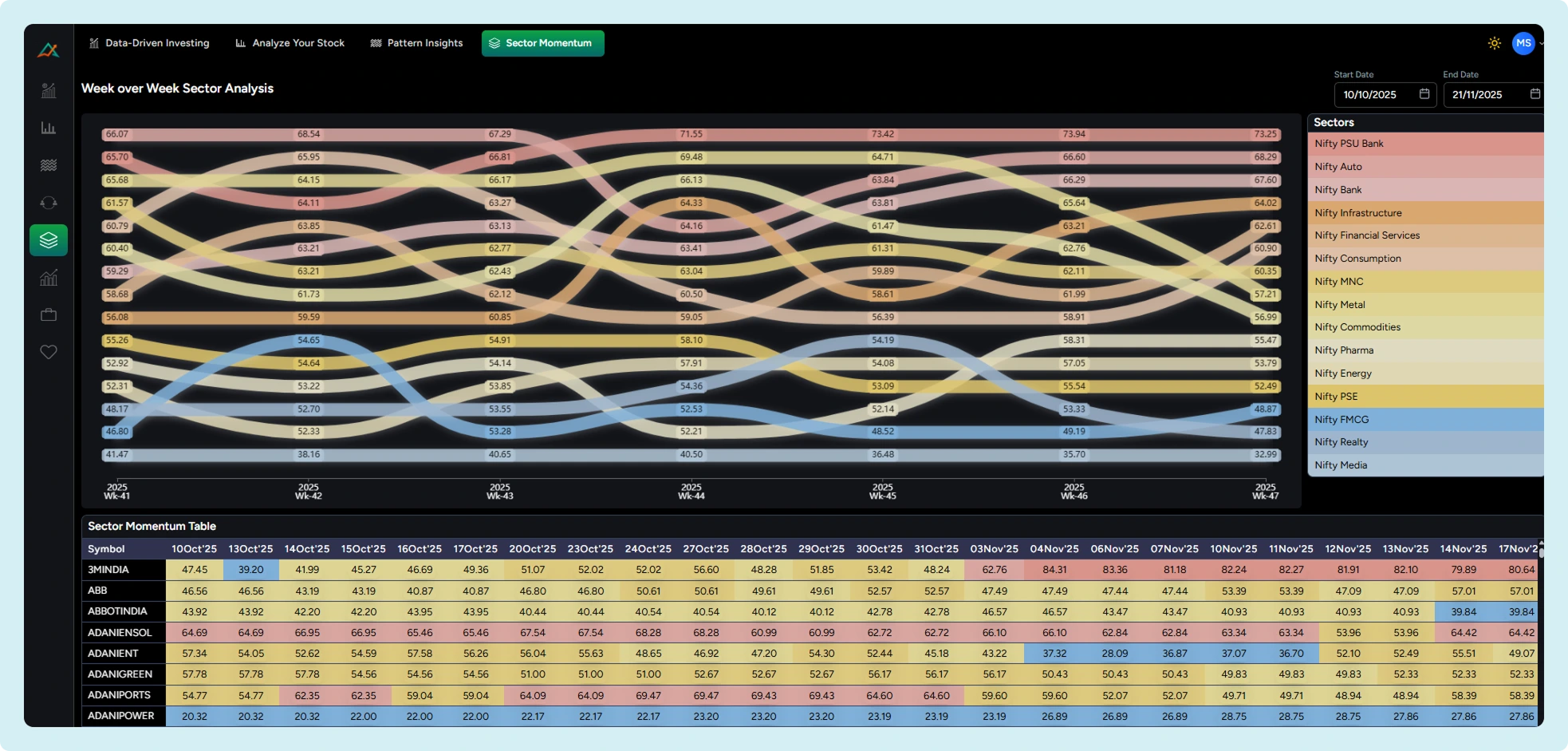

Sector Momentum

Track which sectors are gaining or losing momentum using live money-flow analytics and sector rotation data. Spot outperforming sectors early-and align your investments with where smart money is moving.

Order Blocks

Decode institutional zones of accumulation and distribution with AI-generated order block detection. See exactly where big players are entering or exiting—and use those zones for stronger trade decisions.

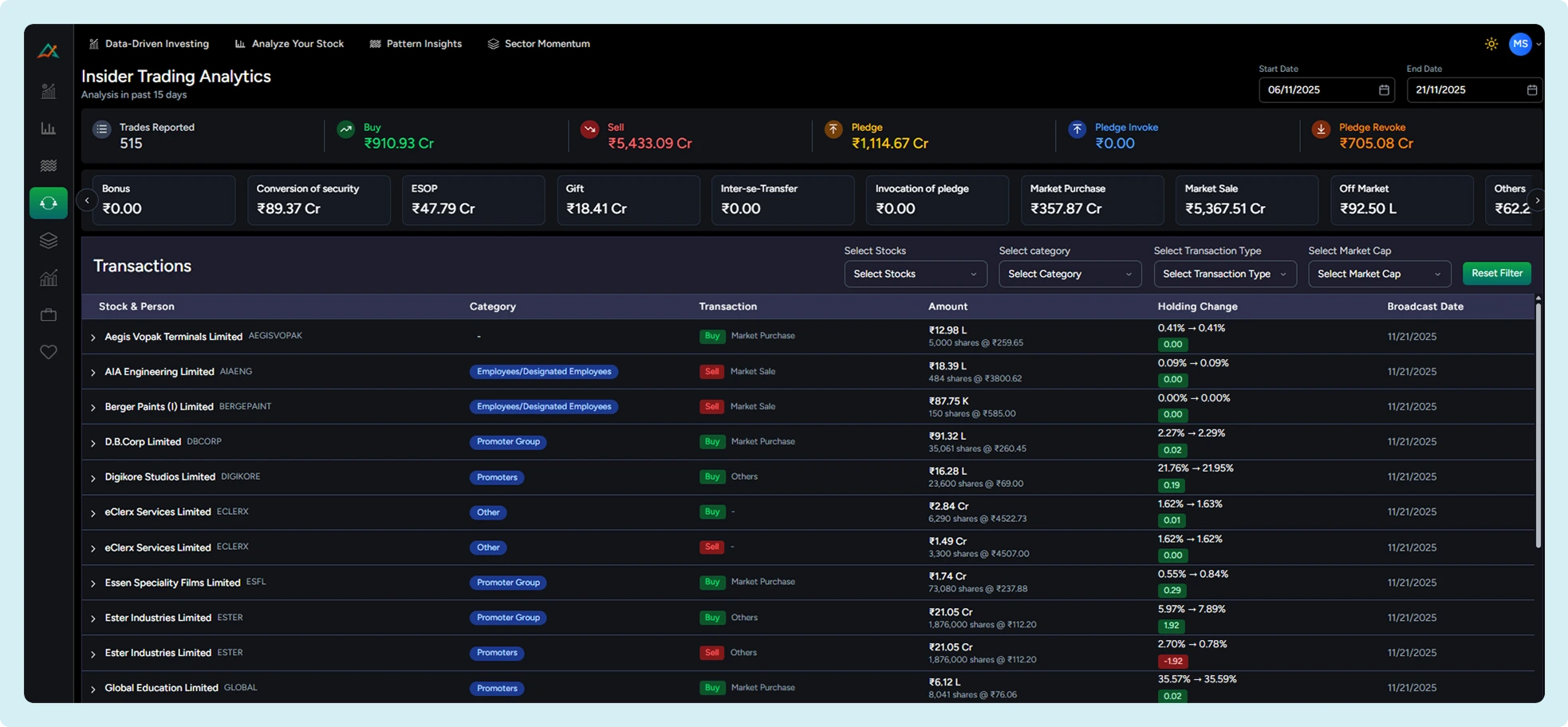

Insider Trading

Get transparency into insider buying, selling, and shareholding changes across the market.

Use insider behaviour to validate decisions and identify early conviction signals from promoters and management.

What Our Partners Says

Stock News & Market Insights

-

2 JuneMarkets resume correction; NIFTY50 falls 180 points while SENSEX ends 0.75% lower

2 JuneMarkets resume correction; NIFTY50 falls 180 points while SENSEX ends 0.75% lower -

2 JuneMarkets resume correction; NIFTY50 falls 180 points while SENSEX ends 0.75% lower

2 JuneMarkets resume correction; NIFTY50 falls 180 points while SENSEX ends 0.75% lower -

2 JuneMarkets resume correction; NIFTY50 falls 180 points while SENSEX ends 0.75% lower

2 JuneMarkets resume correction; NIFTY50 falls 180 points while SENSEX ends 0.75% lower

FAQs

Stop guessing. Start winning.

Let data drive your next trade