Turning Market Complexity into Precision Insights

AI-powered trade analytics for retail traders, fund managers & technical analysts.

Our Story

Abillion Analytics was born from the innovation-driven culture of Atharva System, a technology company known for its excellence in software engineering and product development.

Atharva System began its journey in 2013 when two founders established a strong foundation in Ruby on Rails development. Over the next few years, Atharva expanded rapidly-

This decade of engineering excellence and data-led problem solving paved the way for a new opportunity: applying the same discipline, precision, and product mindset to the world of financial markets. Abillion Analytics is a natural extension of Atharva’s technical DNA—combining software craftsmanship, data science, and market research to build an intelligent analytics platform for traders, fund managers, and financial analysts.

The Evolution

What began as a technology company has grown into a market-intelligence ecosystem.

What began as a technology company has grown into a market-intelligence ecosystem, helping high value retail and institutional traders and professionals decode complex market behaviors using data-driven analytics.

Abillion represents the next chapter where Atharva’s engineering strength meets the future of data-driven investment.

Our Mission

Our mission is simple: to bring clarity to the world’s financial markets.

At Abillion Analytics, we transform raw market data into pure insight-helping investors, traders, analysts, and wealth managers make decisions with confidence, not emotion. We believe everyone deserves access to trustworthy, actionable intelligence once reserved for institutions-powerful, precise, beautifully simple.

We’re here to change the way the world invests and trades.

From Market Data to Meaningful Insights

How it Works

Data Collection

We start by gathering high-quality, real-time market data from trusted and regulated sources. This includes live NSE feeds, corporate announcements, sector movements, macroeconomic indicators, and global sentiment signals.

Our goal is to ensure investors and traders receive the same level of data accuracy that institutional desks rely on.

Example insight:

A study by the European Securities and Markets Authority (ESMA) found that 70–80% of retail investors lose money due to poor data and emotional decisions. Better data is the first step to better outcomes.

Data Processing

Raw market data is rarely useful on its own. Our system cleans, validates, and structures the data-removing noise, anomalies, and inconsistencies.

We then extract sector trends, liquidity patterns, volume shifts, price momentum, volatility cycles, and correlation changes.

This stage helps detect essential signals most traders miss, such as early sector rotation, changing leadership in the market, or sudden weakness in trending themes.

Example insight:

In 2020–2021, tech led the rally. But by late 2021, energy and financials outperformed tech by 30%+, a shift visible through sector analytics long before price reacted.

Machine Learning Models

Our proprietary ML engine applies quantitative models to uncover patterns that are not obvious to the human eye.

These models detect:

• High-probability breakout zones

• Strength of institutional flow

• Trend reliability

• Risk levels and volatility expectations

• Ideal entry/exit zones based on historical patterns

• Momentum decay and reversal signals

We combine pattern recognition, time-series forecasting, momentum analysis, and anomaly detection to build a probability-driven insight framework.

The outcome: insights based on data, not emotion.

Data Analytics Engine

This is where everything comes together. The analytics engine synthesizes processed data and ML

outputs to generate:

• Stock scoring

• High probability stocks

• Sector leadership maps

• Index heatmaps

• Insider trading insights

• Order block opportunities

Every insight is calculated in real time, recalibrated with every new tick of market data.

This ensures traders receive timely, trustworthy, bias-free intelligence.

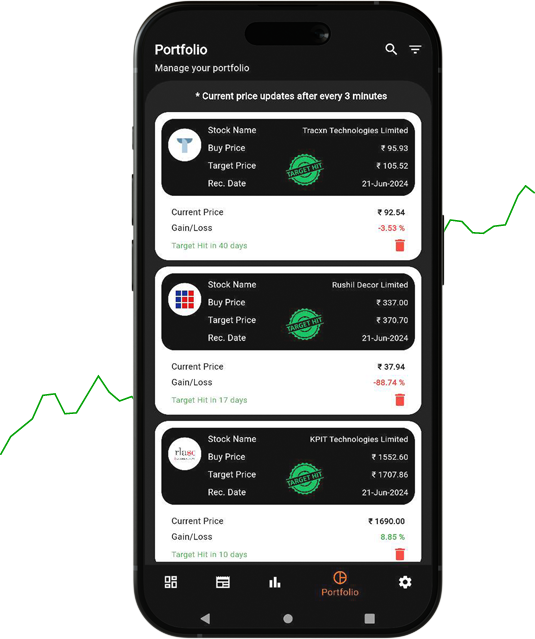

Web / Mobile Dashboards

Finally, insights are delivered through elegant, intuitive dashboards designed for speed, clarity, and decision-making.

Users get:

• Real-time signals

• Portfolio health checks

• Momentum alerts

• Watchlist scoring

• Market heatmaps

• Sector performance

• Entry/exit guidance

We focus on simplicity-turning complex analytics into a clean, visual experience that any trader can use.

Our Team

A sibling venture born from the innovation spirit of Atharva System, Abillion stands on a foundation built by two pioneering visionaries who laid Atharva’s roots Established around 2013-2014.

Natvar Mistry

A 15+ year technology leader and proven founder (CEO, Atharva System).

Sudarshan Rathod

13+ years of expertise in Forex, Crypto, and Global Markets.

Nihal Parmar

Sales & Marketing Executive

Dhrumil Punjabi

Sales & Marketing Executive

Malav Shelat

Product Engineer & Data Scientist

Dharmdipsinh Rathod

Product Engineer & Technical Leadership

Ravi Kumar

Data Analyst

Kaushal Nayak

QA, Testing, & Automation Lead

Ankit Parekh

Software Engineer

Brijesh Shah

Software Engineer

Hiren Joshi

Software Engineer

Dhruv Rathod

QA, Testing, & Automation Expert

Bhavna Sharma

Software Engineer

Megha Vyas

Data Analyst & Researcher

Hema Naidu

Data Analyst & Researcher

Shreya Panchal

QA Engineer

Akshay Mohod

QA Engineer

66.67% CAGR –

Consistent,

Data-Driven

Performance

Users of Abillion Analytics have achieved up to 66.67% CAGR over the past year—a performance that has outpaced major market benchmarks and delivered exceptional results for traders, wealth managers, and institutional participants.

This growth isn’t based on luck. It’s the outcome of disciplined analytics, structured insights, and data-backed decision-making.

Before Abillion Analytics

Data Clutter

Traders face overwhelming noise—multiple indicators, news flows, conflicting signals, and unreliable tips. Identifying meaningful opportunities becomes extremely difficult.

No Clarity

Most retail traders work with partial information or lagging indicators. Without structured insights, they struggle to understand sector trends, risk levels, or the direction of institutional money.

Low Accuracy

Decisions are often made emotionally or based on short-term trends. This leads to inconsistent returns, missed opportunities, and avoidable losses.

Slow Decision-Making

By the time a trend becomes visible manually, the move is already half over. Late entries and poorly timed exits become common.

No Portfolio Visibility

There is little understanding of:

- Concentration risk

- Sector exposure

- Volatility impact

- Probability of upward moves

After Abillion Analytics

Clean, Curated Insights

All market data—NSE/BSE feeds, sector movements, macro signals—is distilled into actionable intelligence. You see only what matters.

High-Probability Trade Opportunities

Our ML engine identifies stocks with strong stock upward probability within the next 14–28 days, giving you a clear edge over discretionary trading.

Improved Accuracy & Timing

Signals are backed by structured data models, trend analysis, and institutional-grade metrics helping you enter early, exit efficiently, and reduce emotional errors.

Sector & Theme Visibility

You instantly see which sectors are strengthening, weakening, rotating, or attracting heavy inflows. This creates a professional-level understanding of market behavior.

Smarter Portfolio Performance

Get a clear view of:

- Expected trend continuation

- Risk-reward potential

- Probability-driven stock scores

- Ideal allocation zones

Outcome:

More confidence. More clarity. More consistency.

Exactly what long-term traders, investors, and institutions need.

Compound Growth Rate

66.67% CAGR

Users of Abillion Trade Analytics have seen as much as 66.67% CAGR in the past year – significantly outperforming typical market benchmarks.

Data Clutter

Data Clutter

No Clarity

No Clarity

No Accuracy

No Accuracy

No Accuracy

No Accuracy

No Clarity

No Clarity

Why Abillion Analytics

Opportunities

AI Analytics

Detection

Growing wealth with

AI-powered data insights.

Why It Matters

With over 4,500 listed companies on Indian stock markets, identifying high-quality trade ideas manually is nearly impossible.

Abillion’s automated analytics surface the most promising opportunities—helping you capitalize on market trends without missing a beat.

Users of Abillion Trade Analytics have seen

as much as 66.67% CAGR in the past year—

significantly outperforming typical market

benchmarks.

Stop guessing. Start winning.

Let data drive your next trade