At Abillion Trade Analytics (ATA), we believe investing should be smarter, more transparent, and accessible to everyone, especially who deserve secure and consistent return on their investment.

By partnering with forward-looking brokers, wealth managers, fintech innovators, and educators, we are building an ecosystem that empowers investors to grow with confidence.

Together, we’re not just delivering data driven insights, we’re transforming how wealth is managed and experienced.

Our Collaboration

Deliver hyper-personalized stock market insights, AI-driven recommendations, and seamless portfolio analytics within your investment and trading ecosystem.

Enhance advisory outcomes with smart asset allocation tools, deep behavioral insights, and real-time risk intelligence tailored for every client.

Embed powerful stock and sector analytics, signals, and market intelligence into your app to boost engagement, user retention, and revenue from premium features.

Enterprise Partners (Banks & NBFCs)

Strengthen customer relationships with enterprise-grade stock, sector, index analytics dashboards, predictive insights, and scalable market intelligence across branches.

Education & Learning Partners

Empower stock, trading enthusiasts and learners and investors with hands-on, real-time market analytics labs and structured learning modules backed by live market data.

Compliance & Transparency

Abillion provides stock, industry analytics and insights – not personalized financial advice.

Our platform is designed as a research and analytics tool, fully aligned with SEBI’s regulatory framework.

This ensures that partners can integrate Abillion SaaS without concerns about advisory compliance, while clients gain access to reliable, transparent, and data-driven insights.

What Makes Abillion Analytics Different

In a crowded market of stock analytics platforms, Abillion stands apart by:

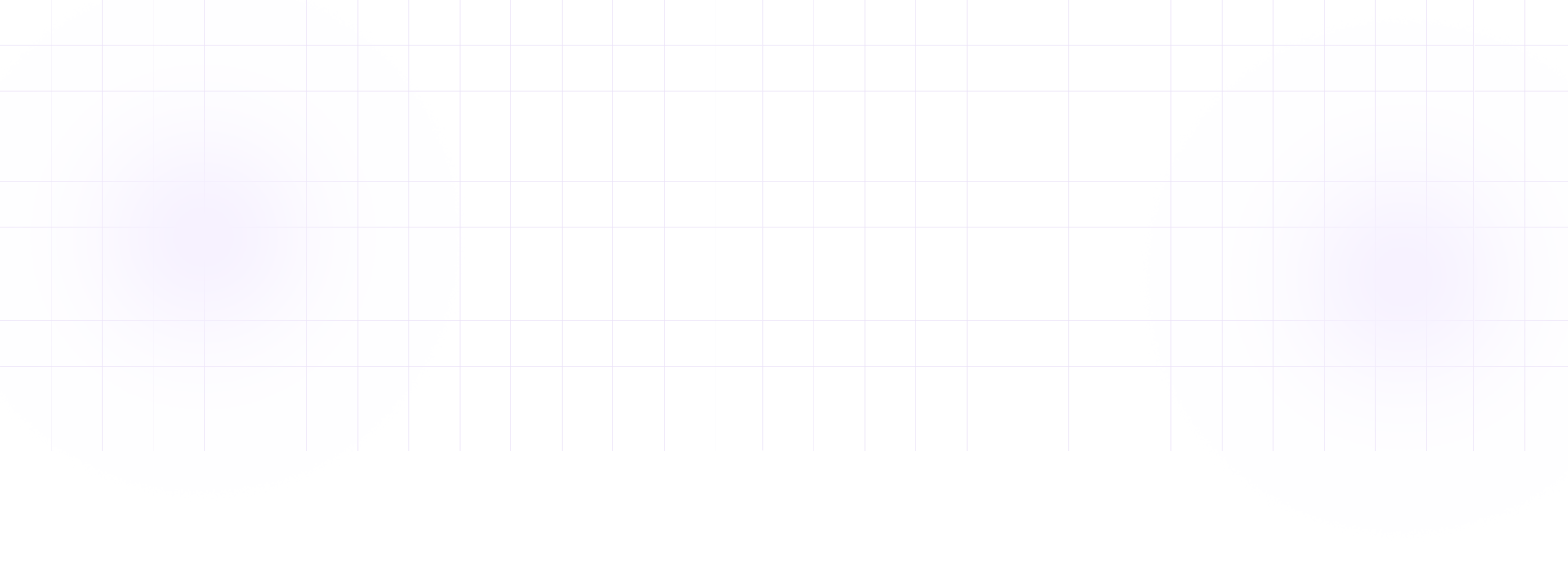

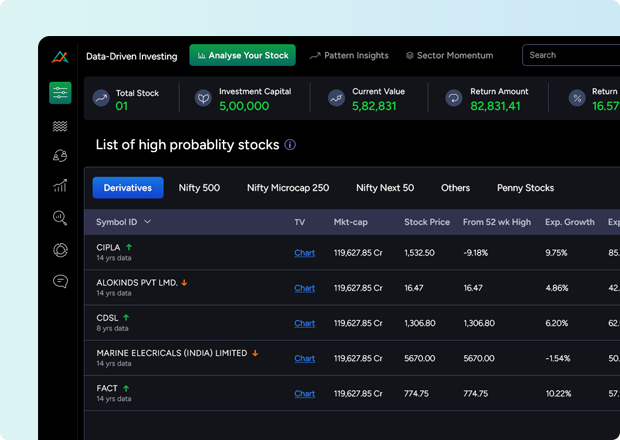

AI-Powered Stock Scoring & Probability

Proprietary machine-learning models that convert millions of market signals into simple, actionable stock scores and assigns high probability. Get instant clarity with insider-flow analysis, order-block tracking, and behavior-based probability scoring for every stock.

End-to-End Portfolio Analytics

Deep analytics that help users monitor their portfolio performance, identify risks, and discover growth opportunities across their entire portfolio. Includes entry and exit analysis, sector allocation insights, rebalancing signals, and efficient stock optimization.

Partner-First Approach

Customizable APIs, white-label dashboards, and seamless integration support designed to fit a wealth management advisor or company adopting Abillion Analytics as their own platform-not the other way around. We collaborate closely to define use-cases, co-create features, and ensure your brand delivers superior stock market intelligence for your end customers.

Scalable for All Segments

Whether you serve retail investors, HNIs, advisors, or institutions, our data engine adapts to every segment’s needs. From lightweight mobile widgets to enterprise-grade analytics, scalability is built into our core architecture.

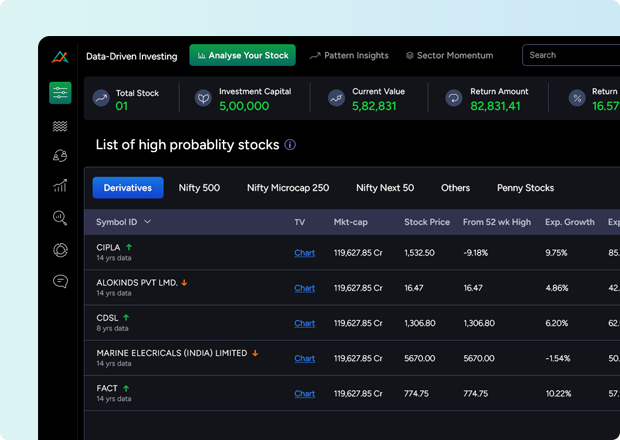

Stock Coverage

Comprehensive coverage across NSE and major Indian indices powered by real-time feeds and multi-factor analysis. Get insights on derivatives, large caps, midcaps, small caps, and sector-specific opportunities in one unified platform.

Data Driven Recommendations

Actionable, explainable ideas built from quantitative models, pattern detection, and predictive analytics. Every recommendation includes rationale, probability metrics, and risk indicators—so users know why something matters.

Expert Team

A team of quants, analysts, technologists, and behavioral-finance specialists who continuously refine our models. Backed by years of software and market experience and rigorous validation to maintain accuracy, reliability, and transparency.

Advisory Support

Dedicated onboarding, co-marketing, training, and go-to-market support for every partner.

Our advisory specialists ensure your users adopt the platform quickly and extract maximum value from day one.

Partner Benefits

Differentiate Your Offering

Differentiate Your Offering

Enhance your product/service with advanced analytics & portfolio intelligence derived from machine learning & global market understanding.

Engage and Retain Clients

Engage and Retain Clients

Deliver data driven insights that build trust and long-term relationships with your clients.

Co-create the Future

Co-create the Future

Work with us to design new tools and experiences that transform wealth management.

Revenue Opportunities

Revenue Opportunities

Access flexible commercial models – from SaaS licensing to co-branded experiences.

Credibility & Visibility

Credibility & Visibility

Join a growing ecosystem recognized by brokers, wealth firms, and fintechs across India.

What Our Partners Says

How to Join

Reach out to our

partnerships team for

an online or

in-person demo.

Get access to the SaaS

application for 30 days,

invest based on our

analytics and find out

the difference in results

and reliability yourself.

Explore integration models,

revenue-sharing, or

white-label options.

Roll out co-branded

solutions and deliver value

to your customers from

day one.

Reach out to us

Support our early partner program and shape

the next generation of wealth platforms.